Slower Permitting and Leasing Process

While the Trump administration has advocated deregulating fossil fuels, offshore wind may face increased regulatory scrutiny. The administration could slow offshore wind development by requiring additional National Environmental Policy Act (NEPA) reviews or stricter environmental assessments. The administration could also deprioritize offshore wind permitting and leasing through staffing reductions, reallocating resources, or increased bureaucratic hurdles. As U.S. offshore wind projects already face lengthy permitting and leasing processes involving multiple federal agencies, any additional uncertainty for the permitting timeline can significantly impact a project’s viability.

Additionally, the administration could issue an executive order or agency directive to place a moratorium on new offshore wind leasing in federal waters. Doing so would halt opportunities for future projects and send a negative market signal.

Why does this matter?

- Delays: Extended timelines will likely increase project costs and discourage developers from pursuing U.S. projects.

- Investor Confidence: Slow progress on permitting would increase uncertainty, making it harder to attract investors.

- Competitor Advantage: Faster permitting processes may give other regions (i.e., Europe and Asia) a competitive edge.

What can the offshore wind industry do?

- Streamline State-Level Process: Work with state governments to create efficient permitting frameworks that reduce potential delays in state-level consenting.

- Explore State-Water Project Development: State-water projects give state governments more control over offshore wind development timelines, reducing the risk of federal permitting delays.

- Advocate for Federal Resources: Work with industry groups to lobby for maintaining federal resources for the Bureau of Ocean Energy Management and other permitting agencies.

Imposing Tariffs on Wind Components

President-elect Trump has continued to advocate and indicate his favorable view on imposing tariffs on imported goods to promote domestic manufacturing. This approach could extend to offshore wind components, many of which are imported from Europe and Asia due to the current limited domestic supply chain.

Why does this matter?

- Increased Costs for Developers: Most major components are sourced internationally. Tariffs on these imports would increase project costs, impacting offshore wind economic viability.

- Increased Pressure to Develop Domestic Supply Chains: While tariffs encourage investment in U.S.-based manufacturing, establishing manufacturing infrastructure takes time, leaving developers with higher costs in the short to medium term.

- Investor Uncertainty: Tariffs create unpredictability in project budgets, potentially deterring investment in U.S. offshore wind.

- Global Response Risks: Foreign trade partners could introduce retaliatory tariffs, complicating trade relationships and access to specialized equipment.

What can the offshore wind industry do?

- Support Domestic Manufacturing: Work with domestic manufacturers to expand their U.S. capacity, reducing reliance on imports over time.

- Optimize Supply Chains: Work with domestic and global suppliers to minimize the cost impacts of tariffs by implementing alternative procurement strategies and logistics.

- Promote Nationwide Domestic Content: Advocate for states to incentivize regional or nationwide domestic-based manufacturing in procurement processes rather than solely rewarding in-state benefits.

Reduced Federal Support and Inflation Reduction Act (IRA) Provisions

The incoming administration could seek to eliminate or reduce federal funding for offshore wind projects. This could include potential cuts to the Investment Tax Credit, which offshore wind developers rely on for financing.

Why does this matter?

- Economic Feasibility: As offshore wind projects are capital-intensive, federal incentives make them more financially viable.

- Increased Costs: Without tax credits, offshore wind would be more expensive, making it less competitive than fossil fuels and the global offshore wind market.

- State Burden: States would likely need to increase their support to fill the gap left by reduced federal funding.

What can the offshore wind industry do?

- Leverage IRA Provisions: Accelerate project timelines to maximize the benefits of existing IRA provisions before potential changes occur.

- Explore Private Financing and Strategic Partnerships: Secure alternative funding by collaborating with private equity firms, institutional investors, or large energy consumers (such as data centers).

- Develop State-Level Incentives: Work with state governments to create tax incentives or grants to offset potentially reduced federal support.

- Make the Economic Case: Emphasize the job creation and economic benefits of offshore wind to encourage bipartisan support for maintaining federal incentives.

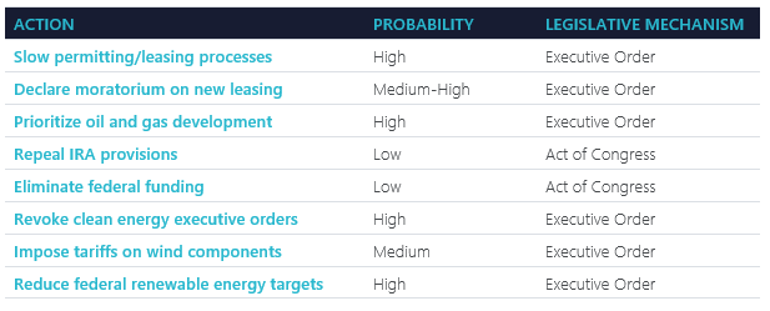

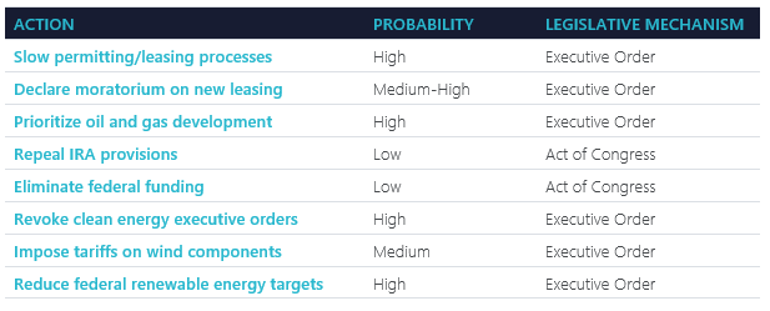

The table below summarizes these potential actions, an estimated probability of them occurring, and whether they require an executive order or an act of Congress to be implemented.

Opportunities and Challenges

Despite potential federal opposition, the offshore wind industry has avenues to continue its growth:

- State-Led Leadership: States with ambitious renewable energy goals remain committed to offshore wind development, providing a critical lifeline for the sector.

- Global Momentum: International investors and developers view the U.S. market as a long-term growth opportunity, even without strong federal support.

- Economic Benefits: Offshore wind’s ability to create jobs and stimulate local economies could be a compelling argument, especially for an administration focused on economic growth.

The Trump administration’s policies could pose significant challenges for the U.S. offshore wind industry. A potential leasing moratorium or reduced federal support could slow progress and increase uncertainty. However, with strong state-level leadership, private investment, and a straightforward economic narrative, the industry has the tools to withstand these challenges and continue moving forward.

What do you think about these potential policy shifts? How else could the offshore wind industry respond? Xodus can help you navigate these uncertainties with our experience in offshore wind development, policy analysis, and financial advisory. Please reach out to Nick Zenkin ((27) Nick Zenkin, PMP | LinkedIn) to discuss this further.